Breakout stock watchlist vs alerts for discretionary traders

A comparison guide to using breakout stock watchlists vs alerts as a discretionary trader—clarify the core tradeoff, map signals to the right workflow, avoid common failure modes, and choose setups/tools that fit your time, regime, and risk control.

Breakout stock watchlist vs alerts for discretionary traders

A comparison guide to using breakout stock watchlists vs alerts as a discretionary trader—clarify the core tradeoff, map signals to the right workflow, avoid common failure modes, and choose setups/tools that fit your time, regime, and risk control.

Are you missing breakouts because you weren’t watching, or taking mediocre trades because an alert dragged you into action? For discretionary traders, the real edge often isn’t a secret indicator—it’s the workflow that gets you in front of the right chart at the right moment.

This comparison shows when watchlists beat alerts (and when they don’t), how each system fails in practice, and how to build a hybrid baseline. You’ll get decision constraints, setup templates, and a rubric so you can pick a process you’ll actually follow.

Decision Framework

Quick definitions

A breakout watchlist is your pre-session short list of “if it moves, I act” names. It produces context: key levels, catalyst notes, and a plan.

Price/volume alerts are automated pings like “above $24.80 on rising volume.” They produce interrupts during the session.

Discretionary decision-making is you choosing, in real time, whether the setup is clean enough to take.

Core tradeoff

Watchlists optimize preparation depth. Alerts optimize reaction speed.

A watchlist reduces bad clicks by pre-defining levels, invalidations, and “no-trade” conditions. Alerts reduce missed breakouts by telling you the moment a level breaks.

If you’re missing trades, add alerts. If you’re taking junk trades, deepen the watchlist.

Best-fit signals

Watchlists win when the breakout needs context, not just a crossed line.

- Premarket ranges that shape the day

- Catalyst nuance that changes follow-through

- Float, borrow, or sector rotation context

- Multi-timeframe levels that stack

- Prior failed breakouts worth remembering

If you need a thesis, you need a watchlist.

Alert-friendly signals

Alerts win when the setup is mechanical and the decision is fast.

- Clean horizontal levels and tight bases

- Momentum continuation through VWAP or HOD

- Intraday breakouts with liquid tape

- Defined risk points near the trigger

- Repeatable triggers across many tickers

If the rule is simple, the alert should fire.

Hybrid baseline

Run a curated watchlist for “deserve attention” names, then add layered alerts for “act now” moments. Use one alert for the level, one for volume or relative strength, and one for a failure line.

Your watchlist filters the universe. Your alerts compress your reaction time.

Build the watchlist to say no, and the alerts to say when.

How Watchlists Work

A breakout watchlist is your pre-built decision set for the session. You do the thinking before the open, then execute off levels when volatility hits.

You’re not hunting “anything moving.” You’re waiting for your names to act right.

Inputs to scan

You need inputs that predict attention, tradability, and clean risk. Think “will it move,” “can I enter,” and “can I exit.”

- Relative volume vs 20-day

- Range contraction and tight closes

- ATR for expected movement

- Catalysts: earnings, news, upgrades

- Float size and short interest

If you don’t scan liquidity and catalysts, you’re scanning for headaches.

Level mapping

Map levels so your decisions become triggers, not debates.

- Mark the prior high that anchors the breakout idea.

- Mark the most recent pivot high or shelf.

- Plot VWAP and note where price reclaimed or lost it.

- Mark premarket high and the premarket range edges.

- Define an invalidation level where the setup is wrong.

Levels turn “I feel like buying” into “I buy if X, risk to Y.”

Context advantage

Context is what keeps you from buying the top tick of a headline candle. When you know the base, the float, and the day’s key levels, you stop treating every green bar as a breakout.

It also frames risk in real units. A $0.30 ATR name trades differently than a $2.50 ATR name.

Your discretion gets sharper when your expectations are preloaded.

Failure modes

Watchlists fail when they become a comfort blanket instead of a filter. The goal is fewer, better decisions.

- Overfitting criteria to last week

- Tracking too many names

- Using stale, unupdated levels

- Getting attached to a bias

- Freezing in analysis paralysis

If you can’t act in 10 seconds, your prep is working against you.

Best use cases

Watchlists dominate when attention is your bottleneck. If you have two screens and a day job, they’re your edge.

They shine in slower markets, when breakouts are selective and late. They also help when you’re transitioning from swing ideas into intraday triggers, or when a catalyst week narrows the field.

When the tape is noisy, a watchlist is your noise-canceling.

How Alerts Work

Alerts are triggers, not trades. You set objective conditions, then you decide if the moment matches your plan. Think: “Ping me at $12.50 with volume,” not “buy $12.50.”

Alert types

Use alerts to catch specific market events without staring at every chart.

- Price cross of a key level

- % change over a set window

- Volume spike vs recent average

- High-of-day break or reclaim

- VWAP reclaim after fade

- Volatility halt and reopen

- News headline or filing drop

Treat each alert as a question, not an answer.

Layering rules

Layer alerts so one signal cannot bully you into a bad fill.

- Set the level alert at your line in the sand.

- Add a volume filter to avoid empty breaks.

- Add a time filter to dodge premarket and lunch noise.

- Check spread and liquidity before you even open Level 2.

- Require a confirmation candle close, not a wick.

Your goal is fewer pings with higher intent.

Discretion checkpoints

When an alert hits, you need a fast checklist that keeps you in charge. You’re answering, “Is this my setup, right now?”

Check five things: trend alignment, level quality, risk distance to invalidation, tape behavior, and market regime. If two are unclear, you pass and wait for a cleaner trigger.

Failure modes

Alerts fail when they increase activity without improving decision quality.

- Noise from over-sensitive thresholds

- Whipsaws around obvious levels

- Late signals after the move

- Overtrading from constant pings

- Alert fatigue and ignored cues

- Technical glitches and missed triggers

If your win rate drops, reduce alerts before you reduce confidence.

Best use cases

Alerts win when your attention is scarce and speed matters. They shine when you’re tracking many tickers, reading a fast tape, or waiting on a specific midday reclaim.

They also fit scalps and quick continuation plays, where the first clean push matters. If you’re context-switching all day, alerts become your guardrails.

Side-by-Side Comparison

Use this table when you trade breakouts by eye, but still want structure.

| Criteria | Watchlist | Alerts | What to do | |—|—|—| | Idea source | Curated names | Rule-triggered pings | Start with watchlist, automate triggers | | Timing | You decide | System decides | Use alerts near levels | | Workload | Daily scanning | Setup once | Save scanning for new themes | | Missed moves | Higher risk | Lower risk | Alert the break zone | | Flexibility | Very high | Medium | Keep discretion after the ping |

If you want fewer “I saw it late” trades, alerts should sit on top of your watchlist.

Cost and Tooling

You either pay upfront for better filtering, or you pay later in missed moves. The real cost is your workflow, not just your subscription.

You’re buying different things with a watchlist versus alerts: attention management versus automation. Here’s the practical spend and friction you can expect.

| Cost / tool area | Watchlist-centric | Alert-centric | Hidden cost |

|---|---|---|---|

| Charting platform | One solid platform | Platform + alert engine | Duplicate subscriptions |

| Market data | Basic real-time | Full depth feeds | Exchange fees stack |

| Scanners | Manual scans daily | Continuous scanning | More false positives |

| Mobile | App check-ins | Push notifications | Alert fatigue |

| Workflow complexity | Simple, repeatable | Rules, tuning, testing | Quietly lost time |

If you can’t explain your stack in one breath, you’re paying a tax every session.

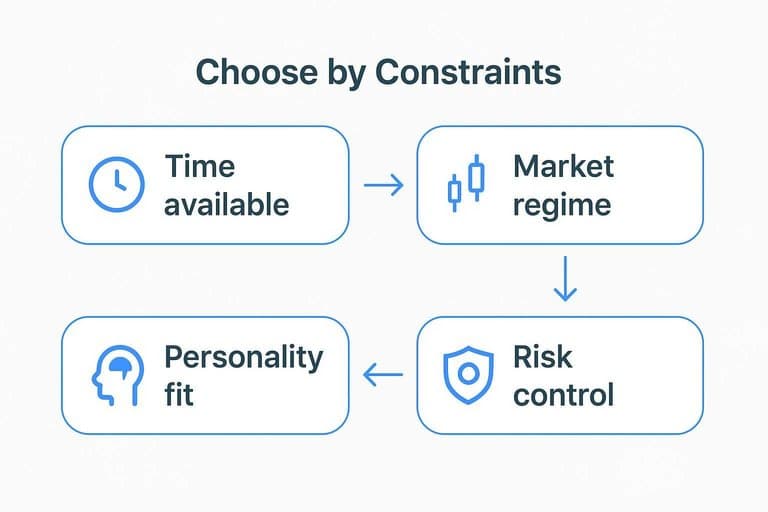

Choose by Constraints

Time available

Decide based on when you can think clearly and when you can click fast. Your tool should match your calendar, not your intentions.

- If you have 20–40 minutes premarket, build a watchlist with keyed levels.

- If you have sporadic screen time, use alerts at preplanned prices.

- If you can’t prep levels, set “context alerts” for HOD, VWAP, and prior close.

- If you can watch the open, favor a watchlist and execute from a tight plan.

- If you can’t watch the open, favor alerts and trade only on confirmation.

Pick the tool that fits your worst day schedule, not your best day fantasy.

Market regime

Different tapes punish different workflows. Match the approach to the regime that’s actually showing up.

- Choppy indexes: alerts, fewer attempts, tighter triggers.

- Trending tape: watchlist, staged entries, add-on plans.

- Earnings season: alerts, because moves start anytime.

- Low-volume summer: watchlist, but demand cleaner setups.

In chop, alerts save you from boredom trades; in trend, watchlists help you press.

Personality fit

If you’re disciplined and patient, a watchlist works because you can wait for “A+ only.” You’ll prep levels, ignore noise, and execute like it’s routine.

If you chase and feel FOMO, alerts can act like guardrails because they delay action until price proves itself. But if alerts trigger your impulse, a watchlist with a written entry rule can slow you down.

Your edge often comes from removing your favorite mistake, not finding a new setup.

Risk control

Your tool should enforce your risk rules, not bypass them. Build constraints first, then choose watchlist or alerts.

- Set a max trades per day, and stop trading when you hit it.

- Define a default stop distance, like “below LOD” or “under VWAP.”

- Size positions from the stop, not from conviction.

- Create no-trade alerts for “too extended” or “into resistance.”

- Add a cool-down rule after a loss, like 10 minutes off.

If your tool can’t enforce brakes, you’re driving fast without a seatbelt.

Common mismatch

A watchlist without an execution plan becomes “pretty charts” and late entries. You’ll see the breakout, hesitate, then buy the top.

Alerts without level prep turn into random pings that feel urgent. You’ll enter without knowing where you’re wrong, so stops get emotional.

The fix is simple: plan levels for alerts, and plan actions for watchlists.

Recommended Setups

You need a setup that matches your attention span and your execution speed. A great plan can still fail when alerts fire like a slot machine.

Watchlist-first

Build a small list so you can see the same charts daily. Repetition sharpens your “that’s clean” instinct.

- Keep 5–15 names, max, in one focused list

- Annotate trigger levels, invalidation levels, and add-on levels

- Write a one-line thesis note: “earnings gap, tight base”

- Add 1–2 confirmation alerts per name, not more

If you need ten alerts per ticker, you don’t have a thesis. You have anxiety.

Alerts-first

Run alerts when you can’t babysit charts or you trade many categories. You’re outsourcing scanning to the platform.

- Set broad universe alerts on liquidity and range expansion

- Use strict filters: volume, ATR, trend, and proximity to level

- Use a post-alert checklist before any order

- Cap daily alerts reviewed and trades taken to avoid churn

If you can’t say “no” fast, alerts turn your day into reactive trading.

Hybrid default

Use a small curated watchlist for your best ideas, plus market-wide alerts to catch fresh breakouts. Your watchlist gets deep prep; your alerts catch the stuff you didn’t know to watch.

This fits traders who can review charts twice a day, but still want surprise winners. You get focus without missing regime shifts.

The trick is role clarity: watchlist alerts confirm, universe alerts discover.

Implementation steps

Roll this out in one week so you can measure, not guess.

- Baseline your current process and record alert count, trades, and P/L.

- Define metrics: win rate, average R, and “alerts-to-trades” ratio.

- Tweak thresholds upward until you cut alerts by at least 30%.

- Remove noise: kill low-liquidity names and duplicate alert types.

- Lock rules for two weeks before changing anything again.

Your edge shows up after the noise is gone, not before.

Final recommendation

For most discretionary breakout traders, run the hybrid: 5–15 curated names with annotated levels, plus one broad universe alert for new setups. Make the watchlist your “A-book,” and treat universe hits as auditions.

Go watchlist-first if you trade a narrow niche and can watch intraday. Go alerts-first only if your filters are ruthless and your self-control is stronger than your curiosity.

Decision Rubric Checklist

Use this rubric to choose watchlist, alerts, or a hybrid, based on your time, style, and execution needs.

| Factor | Score 0 | Score 1 | Score 2 |

|---|---|---|---|

| Screen time | Rarely check | 1–2 times/day | Several times/day |

| Setup complexity | Simple breakouts | Some filters | Multi-condition rules |

| Reaction speed | Can wait hours | Can wait minutes | Must act fast |

| Trade volume | 0–2/week | 3–5/week | 6+/week |

| Miss tolerance | Missing is fine | Some misses hurt | Missing is costly |

How to score and decide (add your five factor scores):

- 0–3 = Watchlist-first. Next action: tighten a daily scan and pre-plan entries.

- 4–6 = Hybrid. Next action: keep a short watchlist, alert only “go-time” levels.

- 7–10 = Alerts-first. Next action: codify triggers and reduce the list.

Your score is really a proxy for one thing: how expensive your attention is.

Pick one default workflow—and lock in your guardrails

- Choose your default for the next 30 sessions: watchlist-first (if you can scan consistently), alerts-first (if time is fragmented), or hybrid (if you want coverage plus context).

- Define three non-negotiables: the breakout definition, the risk unit/stop logic, and the “no-trade” conditions that override any signal.

- Implement the minimum tooling: one daily scan/watchlist routine or a small alert stack with layering rules and a discretion checkpoint.

- Review weekly: log missed A+ setups, false triggers, and rule breaks—then prune symbols/alerts until the system produces fewer, cleaner decisions.

Frequently Asked Questions

Should I build a breakout stock watchlist every day or use a weekly list?

Most discretionary breakout traders do both: a weekly “universe” list (50–200 names) and a daily focus watchlist (10–30 tickers) that you refine pre-market based on volume, news, and key levels.

How many stocks should be on a breakout stock watchlist for discretionary trading?

A practical range is 10–30 names for your active breakout stock watchlist so you can actually monitor setups; keep a larger secondary list (50–200) for candidates you review with scanners.

How do I track whether my breakout stock watchlist process is working?

Log each watchlist name’s outcome with metrics like “trigger rate,” % follow-through after the break (e.g., 1R or 2R), and max adverse excursion, then review results weekly in a spreadsheet or journaling tool like TraderSync or Tradervue.

Can I use scanners instead of a breakout stock watchlist?

Scanners often replace the discovery step, but most traders still keep a breakout stock watchlist to predefine levels, catalysts, and invalidation points so execution is faster and more consistent when a scan hits.

How long does it take to build a breakout stock watchlist each day?

With a saved template and scanner presets, most traders can build a daily breakout stock watchlist in 15–45 minutes; adding deeper chart review and news context often pushes it to 60–90 minutes.

Build a Smarter Breakout Watchlist

Turning a framework into a daily breakout stock watchlist still takes time—especially when leadership, breadth, and themes shift quickly after each close.

Open Swing Trading updates daily RS rankings, breadth, and sector/theme rotation so you can surface breakout leaders fast and build your list in 5–15 minutes—get 7-day free access with no credit card.