7 Top Publicly Traded Drone Companies & ETFs to Watch in 2026

Discover the top publicly traded drone companies and ETFs for 2026. Get actionable swing trading insights to find high-momentum breakout candidates.

The drone industry is hitting a new stride in 2026, driven by advancements in autonomous navigation, defense modernization, and commercial logistics. For swing traders, this translates into a dynamic environment ripe with opportunity. However, chasing headlines isn't a viable strategy for consistent returns. Success lies in identifying specific companies and broader themes that demonstrate genuine momentum and attract institutional capital.

This guide moves beyond generic stock lists. It is a curated collection of the essential tools, thematic funds, and platforms that swing traders can use to build a high-potential watchlist of publicly traded drone companies. We will provide actionable context on how to leverage these resources to find the strongest names, align your trades with dominant capital flows, and capitalize on breakouts with a structured, data-driven approach.

Our goal is to help you filter out the noise and focus on what matters: relative strength, clean technical setups, and quantifiable risk. Each item in our roundup includes direct links and key details to help you quickly integrate them into your daily workflow, whether you have 15 minutes or two hours for market analysis. Consider this your roadmap to pinpointing leadership and executing precise swing trades within the unmanned aerial vehicle (UAV) space. We will dissect ETFs like the REX Drone ETF (DRNZ) for thematic exposure and platforms like Nasdaq for curated research, giving you a clear path from idea generation to trade execution.

1. REX Drone ETF (DRNZ) — Rex Shares

For traders seeking diversified exposure or a high-quality, pre-vetted watchlist of publicly traded drone companies, the REX Drone ETF (DRNZ) platform is an indispensable starting point. Unlike searching for individual stocks, DRNZ offers a curated basket of global companies deeply involved in the drone ecosystem, from hardware manufacturing to software and services. It provides a direct way to trade the entire drone theme without the concentrated risk of a single company's earnings miss or competitive setback.

The platform’s primary utility for swing traders is its transparent holdings page. This section of the website offers more than just a list of tickers; it’s a dynamic, real-time look at where institutional capital is concentrated within the drone sector. By tracking the top-weighted components, you can quickly identify the current market leaders that are attracting the most investment flow.

Actionable Insights for Swing Traders

The DRNZ holdings page essentially acts as a powerful, free scanner. Instead of running complex screens, you can visit the site to instantly generate a high-potential watchlist. The fund is tied to the VettaFi Drone Index and rebalances quarterly, ensuring the components remain relevant and focused on pure-play drone businesses. The key benefit for a swing trader is identifying leadership. By focusing on the top holdings that are also showing technical strength, you can ride momentum waves driven by institutional capital.

A practical workflow for a swing trader could be:

- Weekly Review: Check the top 10 DRNZ holdings every Monday morning. Note any significant changes in weighting, which might signal institutional accumulation or distribution.

- Chart Cross-Reference: Take the top 5 weighted stocks from the DRNZ list and analyze their charts for classic swing trading setups, like bull flags, base breakouts, or pullbacks to key moving averages. This is where you find your entry points for capturing short-to-medium term gains.

- Relative Strength Analysis: Compare the performance of these top holdings against the DRNZ ETF itself and the broader market (e.g., SPY). Focus on names that are outperforming both, as they often lead the next leg up.

This approach filters the universe of publicly traded drone companies down to a manageable list of institutional-grade candidates.

DRNZ Key Details & Trading Considerations

| Feature | Details for Traders |

|---|---|

| Primary Ticker | DRNZ (Traded like any other stock/ETF) |

| Focus | Concentrated exposure to global drone technology companies |

| Accessibility | Available through any major brokerage account. No special access required. |

| Pricing | Traded on an exchange, so you pay the market price plus any commissions. Check the bid/ask spread for liquidity. |

Pros:

- Pure Thematic Exposure: Express a clear bullish or bearish view on the entire drone sector.

- Vetted Watchlist: The holdings page provides an expert-curated list of relevant drone stocks, saving immense research time.

- Risk Management: Diversifies away from single-stock news or earnings-related volatility.

Cons:

- Liquidity & Spreads: As a newer thematic ETF, DRNZ may have lower daily volume and wider bid/ask spreads than large-cap ETFs. Use limit orders.

- Thematic Risk: The fund’s performance is tied directly to investor sentiment for the drone industry. A sector-wide cooldown will impact performance.

For traders looking to efficiently find and validate trade ideas within the drone industry, the DRNZ platform is an essential first stop.

Visit the website: https://www.rexshares.com/drnz/

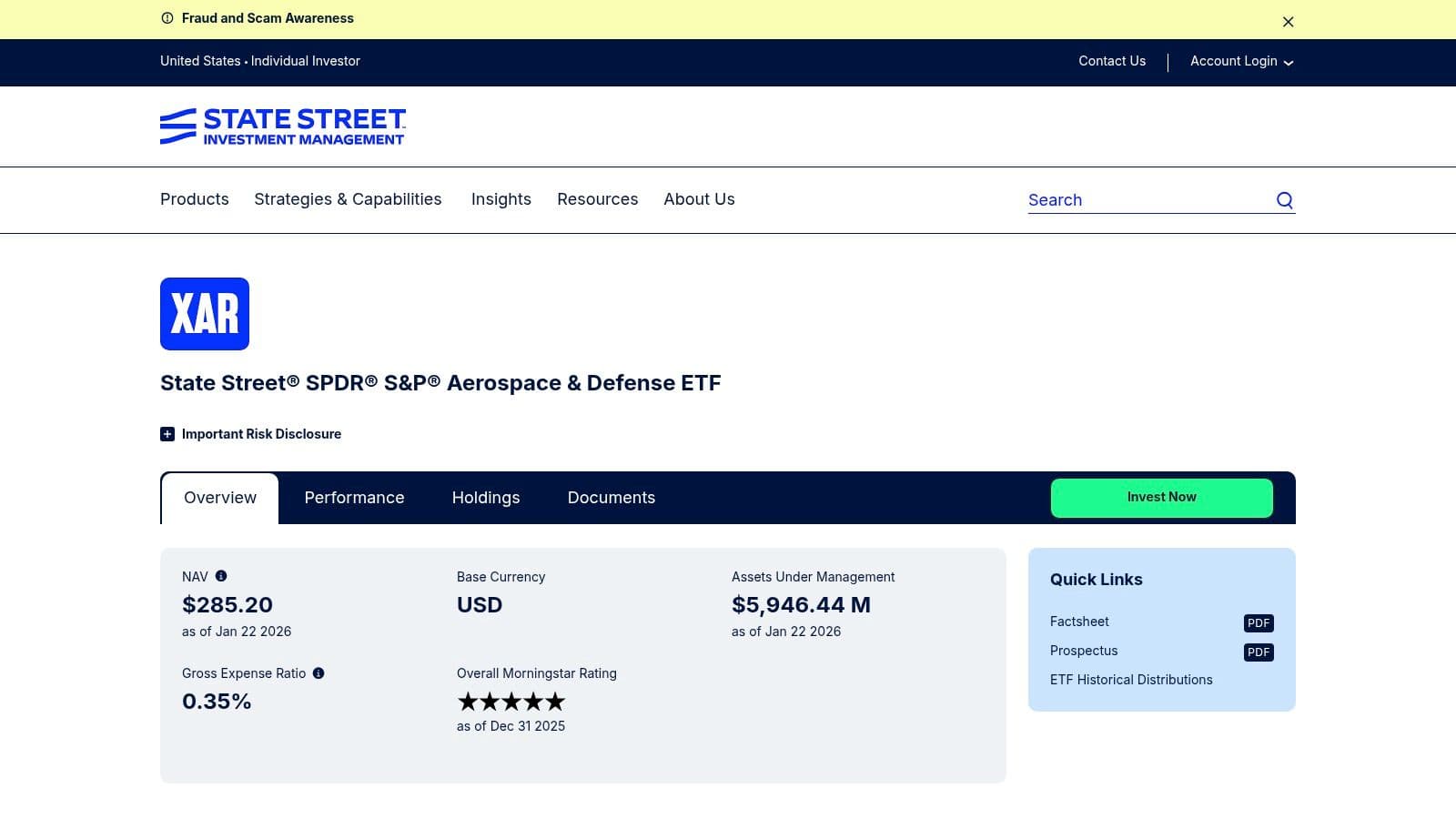

2. SPDR S&P Aerospace & Defense ETF (XAR) — State Street SPDR

For traders looking to uncover emerging leaders among publicly traded drone companies, the SPDR S&P Aerospace & Defense ETF (XAR) website offers a powerful, alternative lens. While not a pure-play drone fund, its equal-weighted methodology provides a distinct advantage. It often gives greater prominence to the mid-cap and small-cap innovators that can deliver explosive moves, companies that might be overshadowed in a market-cap-weighted index.

The platform’s key feature for traders is its transparent and easily downloadable holdings list. This allows you to quickly export the entire portfolio into a spreadsheet or trading platform watchlist. By filtering this list for companies with significant drone operations, you can build a custom universe of stocks that benefit from both broader defense spending and specific drone-related catalysts.

Actionable Insights for Swing Traders

The XAR holdings page is a fantastic tool for hunting momentum in less obvious places. Because every holding starts with a similar weight, it's easier to spot stocks that are outperforming the group on a technical basis, rather than just focusing on the largest companies. This equal-weight approach is ideal for identifying the next high-flyers before they become mega-caps, offering significant upside for well-timed swing trades.

A practical workflow for a swing trader could be:

- Quarterly Watchlist Refresh: Download the full XAR holdings list from the website at the beginning of each quarter. Filter this list to isolate companies with direct drone technology or military drone contracts.

- Momentum Scan: Run a relative strength scan against this curated list. Identify the top 5-10 stocks that are outperforming XAR and the S&P 500 (SPY) over the past month. These are your prime breakout candidates.

- Volume & Setup Analysis: Focus your charting efforts on these leaders. Look for high-volume breakouts from consolidation patterns, pullbacks to the 20-day or 50-day moving average, or other classic swing setups. The equal-weighting helps ensure these are driven by genuine buying interest, not just index rebalancing.

This strategy helps you find high-potential drone and defense stocks that are showing true momentum, away from the crowded mega-cap names.

XAR Key Details & Trading Considerations

| Feature | Details for Traders |

|---|---|

| Primary Ticker | XAR (Highly liquid and traded on major exchanges) |

| Focus | Equal-weighted exposure to U.S. aerospace and defense stocks, including many with drone exposure |

| Accessibility | Available in any standard brokerage account. Holdings data is free to access on the website. |

| Pricing | Traded at the market price plus any standard brokerage commissions. Typically has tight bid/ask spreads due to high volume. |

Pros:

- Mid-Cap Discovery: The equal-weight strategy is excellent for surfacing fast-growing mid-cap companies where significant swing trading gains often originate.

- Transparent & Actionable Data: Daily downloadable holdings make it simple to build and maintain a dynamic watchlist of relevant stocks.

- Broader Sector Confirmation: Provides a view into the health of the entire aerospace and defense sector, which is a key driver for many drone stocks.

Cons:

- Not a Pure Drone Play: The fund includes many traditional defense contractors, requiring you to filter the holdings to find drone-specific names.

- Potential Underperformance: In markets where mega-caps like RTX or LMT are leading, XAR's equal-weighting may lag a market-cap-weighted index.

For traders who want to find the next wave of leadership within the broader defense and drone ecosystem, the XAR platform provides the perfect data to start hunting.

Visit the website: https://www.ssga.com/us/en/individual/etfs/state-street-spdr-sp-aerospace-defense-etf-xar

3. iShares U.S. Aerospace & Defense ETF (ITA) — iShares

For traders wanting to identify large-cap, highly liquid publicly traded drone companies, the iShares U.S. Aerospace & Defense ETF (ITA) website is a critical resource. While not a pure-play drone fund, ITA provides a window into the established, institutionally-backed giants that have significant UAV programs and supply-chain dominance. It acts as an essential benchmark for the defense-oriented side of the drone industry and a source for high-quality, tradable tickers.

The platform’s core utility for swing traders is its detailed, downloadable holdings page. This feature offers a clear list of the companies within the Dow Jones U.S. Select Aerospace & Defense Index. Unlike smaller thematic ETFs, ITA's components are typically well-capitalized leaders, offering the liquidity and institutional attention that active traders require for clean entries and exits.

Actionable Insights for Swing Traders

The ITA holdings page is a powerful tool for sourcing leadership among legacy defense contractors with growing drone divisions. It helps traders look beyond smaller, speculative names to find stable companies that are pivotal to the industry's supply chain and development. These larger players often exhibit clearer, more sustained trends ideal for swing trading over a period of days to weeks.

A practical workflow for a swing trader could be:

- Quarterly Scan: Review the full ITA holdings list after its quarterly rebalance. Identify companies known for their UAV programs (e.g., Northrop Grumman, Lockheed Martin) and flag them on your primary watchlist.

- Liquidity Check: Filter the list for stocks with an average daily trading volume of over one million shares. This ensures you can trade size without significant slippage.

- Relative Strength vs. Sector: Plot the charts of your flagged stocks against ITA itself. Focus on names that are consistently outperforming the ETF, especially during market pullbacks. These are often the true sector leaders poised to break out first when the industry catches a bid, providing prime swing trading opportunities.

This process leverages the institutional vetting of an established ETF to build a watchlist of high-grade drone-related stocks.

ITA Key Details & Trading Considerations

| Feature | Details for Traders |

|---|---|

| Primary Ticker | ITA (Highly liquid and traded on major exchanges) |

| Focus | Exposure to U.S. aerospace and defense giants, many with significant drone operations |

| Accessibility | Available in any standard brokerage account. Options are also available. |

| Pricing | Traded at the live market price. The high volume ensures tight bid/ask spreads. |

Pros:

- Deep Liquidity & High AUM: Easy to trade for any account size with minimal friction.

- Clean Holdings List: Provides a straightforward way to mine for liquid, well-established swing trading candidates.

- Sector Benchmark: Serves as an excellent proxy for the health of the broader U.S. aerospace and defense industry.

Cons:

- Diluted Drone Exposure: Heavily concentrated in a few mega-caps whose stock prices are influenced by many factors beyond just their drone business.

- Market-Cap Weighting: The largest companies dominate the fund, potentially masking the performance of smaller, more innovative players within the holdings.

For traders who prefer to focus on liquid, large-cap names with drone exposure, the ITA website offers an invaluable starting point for idea generation.

Visit the website: https://www.ishares.com/us/products/239502/ishares-u-s-aerospace-defense-etf

4. Invesco Aerospace & Defense ETF (PPA) — Invesco Insights

While not a pure-play drone fund, the Invesco Aerospace & Defense ETF (PPA) platform offers a vital perspective on the broader defense sector where many leading drone innovations originate. For traders, this ETF and its associated Invesco research pages provide a powerful top-down view of the market, revealing how drone technology integrates into the larger national security and defense spending themes. It allows you to trade the established defense giants that are heavily investing in or acquiring drone capabilities.

The platform's primary value comes from its holdings list, which is composed of large, liquid defense contractors. These are the companies receiving multi-billion dollar government contracts, many of which now include significant unmanned systems components. By monitoring the top holdings of PPA, traders can identify the blue-chip names that provide stability and exposure to the drone theme, albeit indirectly.

Actionable Insights for Swing Traders

The PPA holdings page is an excellent resource for generating a watchlist of highly liquid, well-capitalized defense stocks that are often major players in the drone supply chain. Unlike smaller, more speculative drone companies, these names have robust financials and are less susceptible to single-contract risk, making them suitable for more conservative swing trading strategies aiming to capture multi-week trends.

A practical workflow for a swing trader could be:

- Quarterly Rebalance Check: Review the PPA holdings after its quarterly rebalancing. Note any new additions or significant weight increases, which may signal shifting institutional focus within the defense sector.

- Identify Drone-Adjacent Leaders: From the top 10 holdings, identify companies with significant, publicly announced drone or counter-drone programs (e.g., Northrop Grumman, Lockheed Martin). These are your primary watchlist candidates.

- Trade Pullbacks and Consolidations: Use technical analysis to find entry points in these large-cap names. Look for pullbacks to the 50-day moving average or periods of consolidation before a potential breakout, as these stocks tend to trend more predictably than smaller-cap names, offering clearer risk/reward setups.

This method helps traders focus on established, institutional-grade companies among the publicly traded drone companies, balancing thematic exposure with lower volatility.

PPA Key Details & Trading Considerations

| Feature | Details for Traders |

|---|---|

| Primary Ticker | PPA (Highly liquid and traded like any other stock/ETF) |

| Focus | Broad exposure to U.S. aerospace and defense companies, including many with UAV programs |

| Accessibility | Available through any standard brokerage account. |

| Pricing | Traded on an exchange at the market price plus standard commissions. Typically has tight bid/ask spreads due to high volume. |

Pros:

- High Liquidity: PPA is a large, established ETF, making it easy to enter and exit positions with minimal slippage.

- Blue-Chip Exposure: Provides access to financially stable defense contractors that are major players in the drone industry.

- Sector-Wide Bet: Allows traders to capitalize on broad increases in defense spending, a key driver for drone adoption.

Cons:

- Diluted Drone Exposure: As a broad defense fund, its performance is not solely dependent on the drone sector. Pure-play drone stocks can outperform PPA during a drone-specific bull run.

- Slower Growth Potential: The large-cap holdings may not offer the explosive growth potential of smaller, dedicated drone technology firms.

For traders wanting to blend their drone thesis with the stability of the broader defense industry, the PPA platform provides an essential and liquid tool.

Visit the website: https://www.invesco.com/us/en/insights/why-defense-makes-sense.html

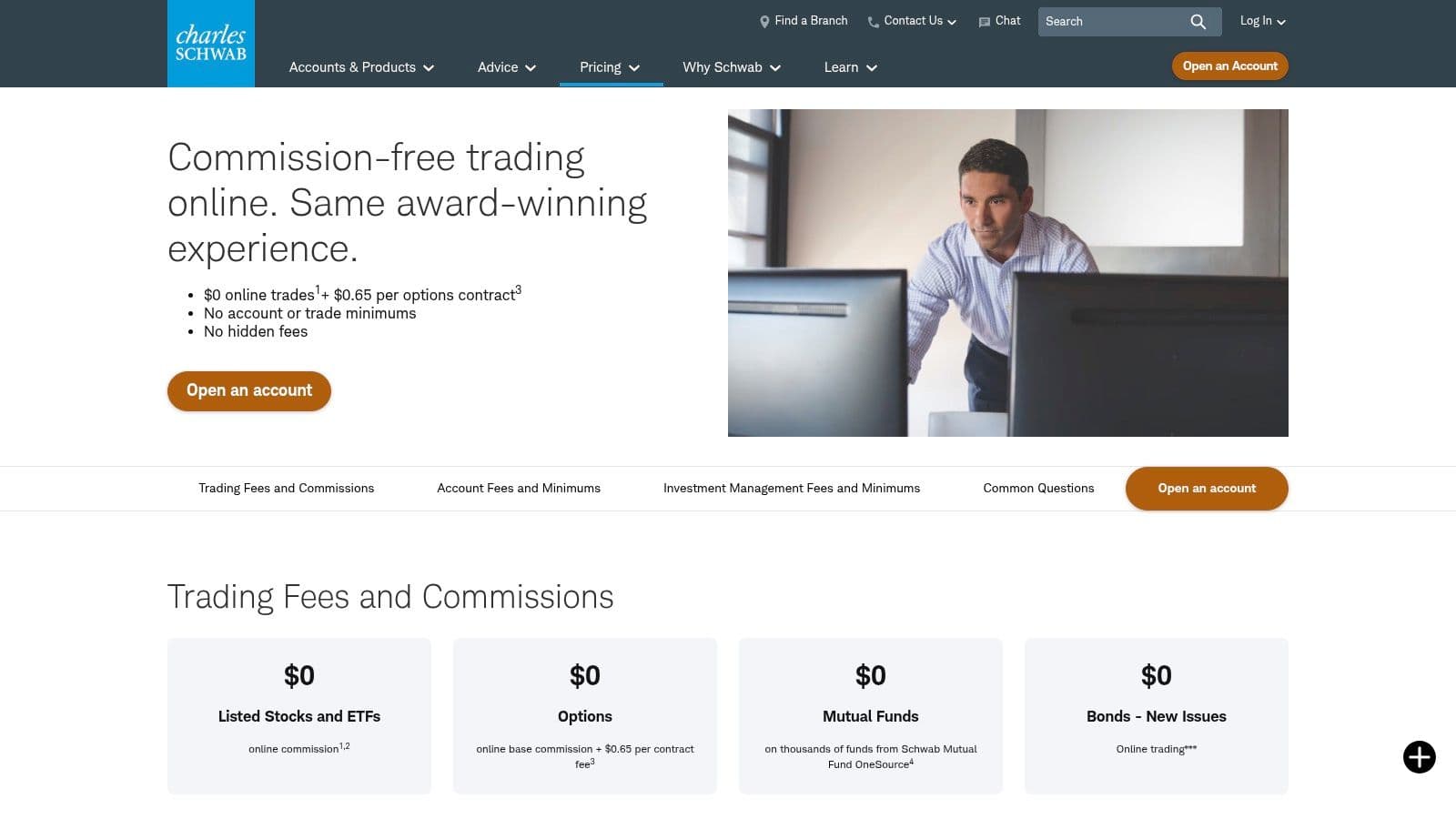

5. Charles Schwab — brokerage and trading platform

Once you have identified high-potential drone stocks, the next critical step is execution. A reliable, low-cost brokerage platform is non-negotiable for swing traders, and Charles Schwab provides the infrastructure to act on your research efficiently. While not a drone-specific platform, it is the arena where you will build watchlists, analyze charts, and ultimately deploy capital into the publicly traded drone companies you have vetted.

The platform's primary advantage for active traders is its cost structure. With $0 online commissions on U.S. stocks and ETFs, you can enter and exit positions without friction costs eating into your profits. This is especially beneficial for swing trading strategies that involve scaling in or out of positions or taking small, quick gains on momentum moves. The platform's stability and robust account protections offer peace of mind, ensuring your focus remains on trading, not on platform reliability.

Actionable Insights for Swing Traders

Schwab’s platform is more than just an order entry system; it is a central hub for managing your drone sector trading plan. Its tools allow for seamless integration of research and execution, turning your list of target companies into live trades. Smart swing trading involves not just finding the right stock, but managing the trade effectively to maximize profit and minimize risk.

A practical workflow for a swing trader using Schwab could be:

- Build a Dynamic Watchlist: Create a dedicated watchlist named "Drone Stocks 2026." Add tickers identified from sources like the DRNZ ETF holdings or scanners. Use Schwab’s columns to display real-time data like volume, daily change, and 52-week range.

- Set Precise Alerts: Instead of constantly watching screens, set price alerts for key breakout levels or pullbacks to moving averages on your target drone stocks. For example, set an alert on a drone hardware stock when it approaches its 50-day moving average.

- Execute with Advanced Orders: Use conditional orders like One-Cancels-the-Other (OCO) to place a profit target and a stop-loss simultaneously. This automates your trade management, enforcing discipline and freeing you to find the next opportunity.

This approach transforms a list of tickers into an actionable and manageable trading strategy within a single, powerful platform.

Charles Schwab Key Details & Trading Considerations

| Feature | Details for Traders |

|---|---|

| Primary Ticker | SCHW (Company is publicly traded, platform is for brokerage) |

| Focus | Low-cost execution, watchlist management, and trading for U.S. stocks & ETFs |

| Accessibility | Open to U.S. investors; no account minimums to get started. |

| Pricing | 0 online commissions for U.S. stocks and ETFs. Options are 0.65 per contract. |

Pros:

- Low Trading Costs: The $0 commission model is ideal for frequent rebalancing and active swing trading strategies without eroding returns.

- Platform Stability: As a widely used, major brokerage, it offers strong account protections and a reliable trading experience.

- Extended Hours: Supports extended-hours trading, allowing you to react to pre-market or after-hours news on drone companies.

Cons:

- Limited International Access: Finding and trading some international or micro-cap drone stocks can be difficult; many may require ADRs or are not available.

- Data Feeds: While excellent for most traders, the real-time data may not match the speed of specialized direct-access platforms for high-frequency trading.

For traders needing a cost-effective and reliable platform to execute their strategies on publicly traded drone companies, Charles Schwab is a top-tier choice.

Visit the website: https://www.schwab.com/pricing

6. Interactive Brokers (IBKR) — global brokerage

For active traders looking to execute on opportunities within the universe of publicly traded drone companies, Interactive Brokers (IBKR) offers a professional-grade trading infrastructure. While not a research tool for finding stocks, it is the platform where speed, execution quality, and global access converge. It's the ideal destination for traders who have already identified their targets and require sophisticated tools and low-cost execution to maximize their edge.

The platform’s core advantage for drone stock traders is its direct access to global markets. Many innovative drone component suppliers and manufacturers are listed on international exchanges in Europe and Asia. IBKR allows traders to directly trade these non-U.S. stocks, rather than being limited to American Depositary Receipts (ADRs), providing access to a wider pool of pure-play drone companies.

Actionable Insights for Swing Traders

IBKR’s advanced Trader Workstation (TWS) platform is a powerful tool for managing a portfolio of drone stocks with precision. Its smart routing technology seeks the best available price across multiple market centers, which is critical for getting quality fills on less liquid, small-cap drone names. The platform's professional-grade tools enable a more sophisticated trading workflow, which is a key benefit for swing traders looking to optimize every entry and exit.

A practical workflow for a swing trader using IBKR could be:

- Global Watchlist Creation: Build a comprehensive watchlist that includes U.S. drone stocks alongside their international peers and suppliers identified from ETF holdings or global screeners.

- Advanced Order Execution: Use IBKR’s advanced order types, like bracket orders (attaching a take-profit and stop-loss simultaneously) or conditional orders, to automate trade management for volatile drone stocks. This enforces trading discipline automatically.

- Shorting and Hedging: For traders looking to play both sides, IBKR offers a robust stock-locate tool for finding shares to short, enabling you to capitalize on overextended drone stocks or hedge a long portfolio.

This approach transforms a simple buy-and-sell strategy into a professionally managed trading operation.

IBKR Key Details & Trading Considerations

| Feature | Details for Traders |

|---|---|

| Primary Ticker | IBKR (The brokerage itself is publicly traded) |

| Focus | Low-cost, high-speed trade execution across global markets |

| Accessibility | Requires opening a brokerage account; TWS platform has a steeper learning curve than retail-focused apps. |

| Pricing | IBKR Pro offers very low per-share commissions, ideal for active traders. IBKR Lite offers zero commissions on U.S. stocks/ETFs. |

Pros:

- Superior Execution: Smart routing and deep liquidity provide excellent fills, minimizing slippage on entries and exits.

- Global Market Access: Trade drone-related companies directly on their native exchanges in Europe, Asia, and beyond.

- Professional Tools: Advanced order types and short-selling capabilities provide a significant edge for active swing traders.

Cons:

- Steep Learning Curve: The Trader Workstation (TWS) platform is powerful but can be overwhelming for beginners.

- Data Fees: Access to real-time, professional-grade market data may require monthly subscription fees.

For serious traders who demand precision and access to the global drone market, IBKR is an indispensable execution platform.

Visit the website: https://www.interactivebrokers.com/commissions

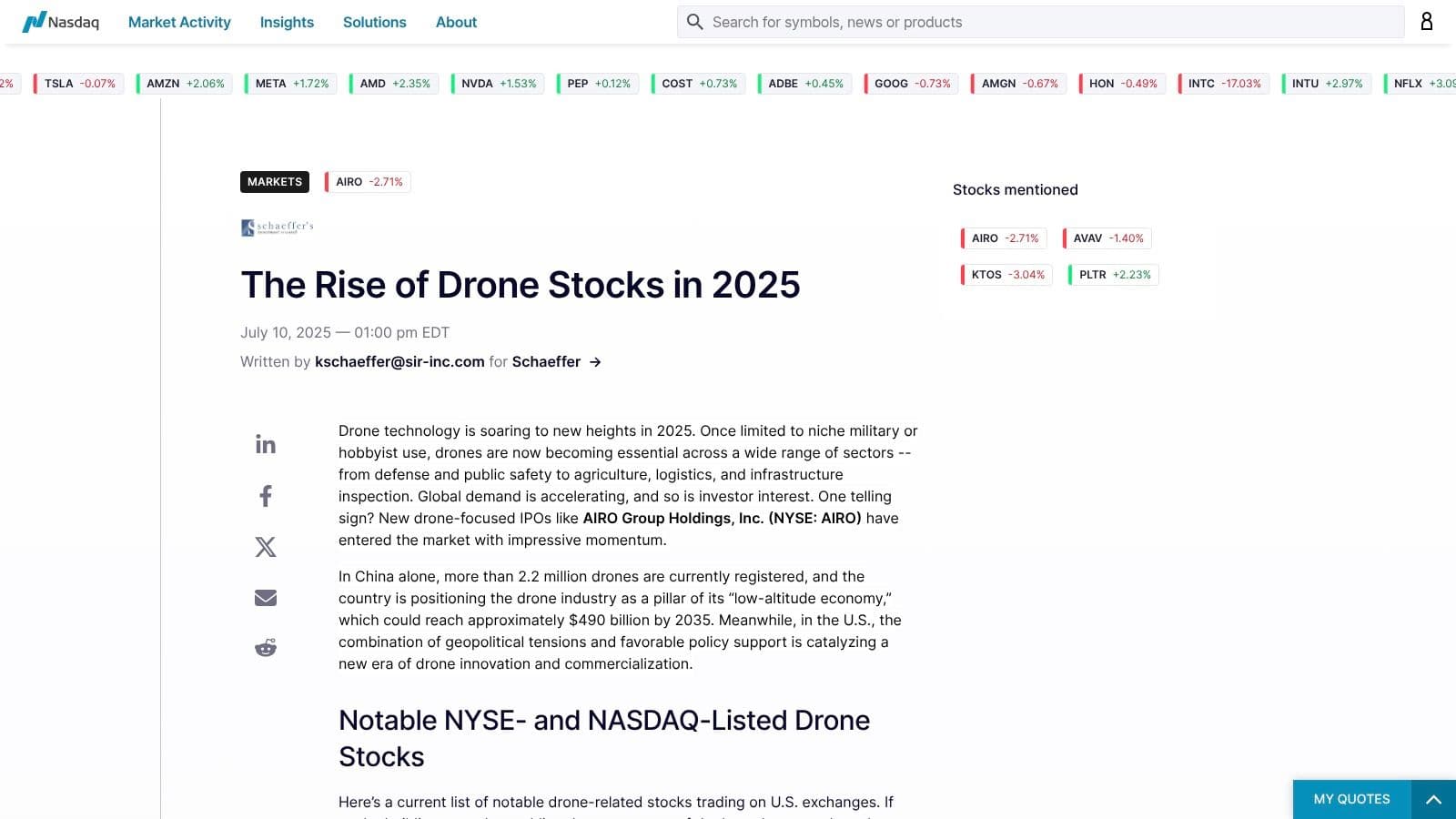

7. Nasdaq — articles and curated drone stock lists

For swing traders looking to stay ahead of market narratives and discover under-the-radar tickers, Nasdaq.com's editorial content is a powerful, free resource. Unlike static screeners, Nasdaq publishes timely articles and curated lists that contextualize the drone sector. These pieces often highlight emerging companies, new contract wins, or regulatory shifts, providing the "why" behind a stock's potential move before it appears on standard momentum scans.

The platform's value lies in its ability to quickly seed a watchlist with fresh ideas, especially smaller-cap or newly listed companies that larger institutional funds may not yet cover. For traders who thrive on news flow and catalyst-driven events, these curated lists serve as a high-potential starting point for further technical analysis and due diligence. It's an efficient way to find publicly traded drone companies that are making headlines.

Actionable Insights for Swing Traders

Using Nasdaq's content effectively means treating it as an idea generation engine rather than a direct trading signal. The articles provide the fundamental story or catalyst; the swing trader’s job is to find the corresponding technical setup on the charts to define a low-risk entry. This combination of catalyst and technical confirmation is a powerful recipe for a successful trade.

A practical workflow for a swing trader could be:

- Set Up Alerts: Create a news alert (e.g., via Google Alerts) for

site:nasdaq.com "drone stocks"to be notified of new content. - Catalyst-Driven Watchlist: When a new article is published, scan the mentioned tickers. Add any unfamiliar names or those with a specific catalyst (e.g., "secured a new defense contract") to a dedicated watchlist.

- Chart Validation: Analyze the charts of these newly added tickers. Look for signs of accumulation, such as rising volume on up days, or classic consolidation patterns like a high-tight flag forming after the news breaks.

- Entry Planning: If a stock from the list forms a valid technical setup, you have both a fundamental catalyst and a technical entry point, creating a high-conviction trade idea.

This process transforms editorial content into a systematic pipeline for discovering and vetting catalyst-driven trading opportunities.

Nasdaq Key Details & Trading Considerations

| Feature | Details for Traders |

|---|---|

| Primary Ticker | N/A (Information source, not a tradable asset) |

| Focus | Idea discovery and context on catalysts for U.S.-listed drone companies |

| Accessibility | Free to access on the Nasdaq.com website. No account required. |

| Pricing | Free. The content is supported by advertising and other Nasdaq services. |

Pros:

- Fresh Ticker Discovery: Excellent for finding smaller-cap or newly relevant stocks that may not appear on broad-based screens.

- Catalyst Context: Provides the fundamental story behind a potential price move, which is critical for catalyst-driven swing trading.

- Time-Saving: Quickly generates a list of relevant names, saving hours of manual research and news scanning.

Cons:

- Editorial Bias: Content may sometimes reflect a promotional angle or be based on company press releases. Always verify with your own research.

- Requires Vetting: The lists are for idea generation; traders must still perform their own technical analysis to find actionable setups.

For traders looking to get an edge by identifying news-driven moves early, Nasdaq's curated content is a vital part of the research toolkit.

Visit the website: https://www.nasdaq.com/articles/rise-drone-stocks-2025

7-Point Comparison: Public Drone Investment Options

| Item | 🔄 Implementation complexity | ⚡ Resource / Execution | ⭐📊 Expected outcomes | 💡 Ideal use cases | Key advantages |

|---|---|---|---|---|---|

| REX Drone ETF (DRNZ) — Rex Shares | Low — buy and hold ETF; quarterly rebalancing | Moderate ⚡ — exchange‑traded; smaller AUM can widen spreads | High ⭐⭐⭐ / Focused impact 📊 — pure drone exposure, concentrated risk | Thematic traders wanting direct drone exposure or a vetted drone watchlist | Pure drones theme; live holdings and fund stats for screening |

| SPDR S&P Aerospace & Defense ETF (XAR) — State Street SPDR | Low — equal‑weighted methodology, regular updates | Moderate ⚡ — good liquidity; daily downloadable holdings | Moderate‑High ⭐⭐📊 — surfaces mid/small‑cap leaders and swing opportunities | Swing traders seeking emerging defense/drone breakouts | Equal‑weight reduces mega‑cap dominance; transparent holdings |

| iShares U.S. Aerospace & Defense ETF (ITA) — iShares | Low — market‑cap index tracking (Dow Jones) | High ⚡ — deep liquidity and large AUM; easy execution | Moderate ⭐⭐ / Strong benchmark impact 📊 — broad sector exposure, mega‑cap concentrated | Traders needing highly liquid, tradable large‑cap positions | Large AUM and liquidity; clean holdings for mining liquid candidates |

| Invesco Aerospace & Defense ETF (PPA) — Invesco Insights | Low — index tracking with quarterly reconstitution | Moderate ⚡ — sizable fund with institutional following; research resources | Moderate ⭐⭐ / Broad impact 📊 — diversified defense exposure, less pure drone focus | Investors wanting long‑running defense exposure with research context | Tenured fund; Invesco insights contextualize holdings and themes |

| Charles Schwab — brokerage and trading platform | Low — user‑friendly platform, simple order flow | Low ⚡ — $0 US stock/ETF trades; extended hours; limited intl microcaps | Moderate ⭐⭐ / Execution impact 📊 — cost‑efficient for frequent retail trading | Cost‑sensitive swing traders building and trading watchlists | Low trading cost, wide retail adoption, strong account protections |

| Interactive Brokers (IBKR) — global brokerage | High 🔄 — advanced platform, steeper learning curve | Low ⚡ — very low commissions, smart routing, 170+ markets | High ⭐⭐⭐ / Execution & reach 📊 — superior fills and global access for non‑US names | Active/professional traders needing global markets, shorting, advanced orders | Deep market access, advanced order tools, excellent trade execution |

| Nasdaq — articles and curated drone stock lists | Low — editorial content and curated lists, easy to read | Low ⚡ — free discovery; not an execution platform | Moderate ⭐⭐ / Discovery impact 📊 — surfaces fresh tickers and catalyst context | Idea discovery, watchlist seeding, pre‑trade research | Fast idea flow; up‑to‑date lists and catalyst summaries |

From Watchlist to Action: Your Next Steps in Drone Sector Trading

We've navigated the essential landscape of publicly traded drone companies, moving beyond simple stock tickers to explore the strategic tools and thematic ETFs that form the foundation of a robust trading plan. The journey through specialized funds like the REX Drone ETF (DRNZ) and broader aerospace powerhouses like XAR and ITA has illuminated the sector's key players. We've also detailed how elite brokerage platforms such as Charles Schwab and Interactive Brokers, along with informational resources like Nasdaq, serve as the functional bedrock for executing your strategy.

The core lesson for swing traders in 2026 is clear: success in this dynamic sector requires moving from passive observation to an active, data-driven process. The era of simply picking a "drone stock" and hoping for the best is over. Today's volatile markets demand a systematic approach that filters for strength, confirms market context, and manages risk with precision. Your primary takeaway should be the power of layering multiple tools to build a high-probability trading thesis.

Synthesizing Your Drone Trading Workflow

The real edge comes not from using a single tool, but from creating a workflow that combines their strengths. The goal is to build a funnel that starts broad and systematically narrows down to the most promising breakout candidates. The benefit of this swing trading approach is a repeatable process that identifies high-probability setups, allowing you to consistently exploit market volatility.

- Step 1: Sourcing Candidates. Begin with the holdings of thematic ETFs like DRNZ, XAR, and PPA. These funds have already performed a level of due diligence, giving you a pre-vetted universe of relevant publicly traded drone companies and adjacent aerospace names. This is your initial, high-quality watchlist.

- Step 2: Objective Strength Analysis. This is the most critical step. Take your sourced list and analyze each stock through the lens of volatility-adjusted relative strength. Your objective is to identify which companies are outperforming not just the broader market (like the S&P 500) but also their direct sector peers. This isolates true leadership from the laggards.

- Step 3: Technical and Contextual Confirmation. Once you have a shortlist of leaders, apply your technical analysis. Look for classic breakout patterns, consolidation near key price levels, or signs of institutional accumulation. Crucially, confirm that the broader market and the aerospace/defense sector are in a healthy uptrend. Trading the strongest stock in a failing market is a low-probability endeavor.

Key Insight: Your trading plan should be a system, not a collection of disconnected ideas. The process of sourcing from ETFs, qualifying with relative strength data, and timing with technical analysis creates a repeatable, disciplined framework that mitigates emotional decision-making.

Putting It All Together: A Practical Example

Imagine you've identified a promising drone component manufacturer from the DRNZ holdings. Instead of immediately placing a trade, your new workflow kicks in. You first confirm its relative strength is in the top decile compared to its industry group. Next, you observe the stock is forming a tight price consolidation just below its 52-week high, a classic breakout signal.

Finally, you verify that the broader market indices are above their key moving averages and the XAR aerospace ETF is also showing positive momentum. With all three conditions met (strong stock, clean pattern, and supportive market), your trade transforms from a speculative guess into a calculated, high-probability setup. This is the essence of professional swing trading: stacking the odds in your favor before risking a single dollar.

The drone sector, with its constant innovation and geopolitical significance, will continue to present incredible trading opportunities throughout 2026 and beyond. By adopting a structured, data-first approach, you position yourself to capitalize on these movements with clarity and confidence. The tools are available; the challenge is to integrate them into a disciplined process that turns market noise into actionable signals.

Ready to stop guessing and start measuring? The OpenSwingTrading platform provides the volatility-adjusted relative strength data and market context analysis discussed throughout this article, helping you pinpoint the strongest publicly traded drone companies poised for breakouts. Transform your watchlist into a data-driven action plan today.