QQQ vs SPY A Definitive Swing Trading Comparison

A definitive QQQ vs SPY comparison for swing traders. Analyze volatility, sector exposure, and key performance metrics to find the right ETF for your strategy.

When it comes down to the QQQ vs. SPY debate, the core difference is simple: SPY is your proxy for the broad U.S. stock market, while QQQ is a concentrated, tech-heavy momentum machine. For a swing trader, the choice isn't about which is better, but which tool is right for the job right now. Are you trying to trade the health of the entire market, or are you looking to ride the aggressive moves of its growth leaders?

QQQ vs. SPY: A Swing Trader's Verdict

For a discretionary swing trader, picking between QQQ and SPY is purely a tactical decision based on the current market environment. Their fundamental makeup dictates their behavior. SPY tracks the S&P 500, giving you a diversified snapshot of the U.S. large-cap economy. On the other hand, QQQ follows the Nasdaq-100, which is almost entirely focused on non-financial growth and technology giants.

This structural divergence creates two very different beasts. Think of SPY as a reliable barometer for overall market sentiment. Its price action is generally smoother and reflects broader economic winds, making it a solid choice for trading the market’s general direction or hedging a portfolio.

QQQ is a different animal altogether. It’s the go-to for traders hunting for momentum and relative strength. That heavy concentration in tech and growth means it often moves further and faster than SPY, especially when those sectors are in favor. This volatility is exactly what swing traders look for, as it creates bigger, more frequent price swings over a few days or weeks. An open swing trading approach thrives on identifying these periods of high momentum and aligning with the market's strongest trends.

Here's the key takeaway: SPY tells you what the market is doing, but QQQ tells you who is leading it. Smart swing traders know how to read this and position themselves where the capital is flowing.

To make the right call, you need to know the core metrics that set these two ETF giants apart. The table below cuts right to the chase, highlighting the attributes that matter most to an active trader.

QQQ vs SPY Core Metrics for Swing Trading

| Metric | Invesco QQQ Trust (QQQ) | SPDR S&P 500 ETF Trust (SPY) |

|---|---|---|

| Underlying Index | Nasdaq-100 | S&P 500 |

| Number of Holdings | Approximately 100 | Approximately 500 |

| Primary Sector Focus | Technology, Communication Services | Diversified across all sectors |

| Volatility | Higher | Lower |

| Expense Ratio | 0.20% | 0.09% |

| Best For Swing Trading | Momentum, breakouts, "risk-on" trends | Broad market trends, hedging, "risk-off" stability |

This comparison clearly lays out the trade-off. With QQQ, you get higher growth potential and momentum, but you also take on more volatility and concentration risk. SPY offers stability and broad exposure, but you risk getting left behind in a roaring, tech-led rally.

Ultimately, the right choice is situational. It depends on your personal risk tolerance and, more importantly, what the market itself is telling you through objective signals.

Getting to Know the DNA of QQQ and SPY

Before you can effectively swing trade QQQ or SPY, you have to understand what makes them tick. The core differences in their structure are exactly why they perform so differently. These aren't just random baskets of stocks; they are purpose-built indexes with rules that give each a distinct personality a trader can exploit.

SPY mirrors the S&P 500, which is a committee-selected index of roughly 500 of the biggest, most established companies in the United States. The whole point of the S&P 500 is to be a broad snapshot of the entire U.S. large-cap market.

QQQ, on the other hand, tracks the Nasdaq-100 index. This is a much tighter list of the 100 largest non-financial companies listed on the Nasdaq. That single rule—kicking out the financials—is a massive differentiator and the main reason QQQ has the unique character it does.

The Nasdaq-100: A Pure Growth Engine

The way the Nasdaq-100 is built gives it a natural slant toward innovation and growth. By design, it filters out all the banks, insurance firms, and other financial institutions, which automatically concentrates its holdings in sectors like technology, communication services, and consumer discretionary.

This structure creates a high-octane trading vehicle, perfect for when you want to ride market momentum. When big money is flowing into growth and tech, QQQ is built to capture that move aggressively. For a swing trader, this often translates into cleaner, more powerful trends when technology is leading the charge. You get direct exposure to the market’s primary growth drivers without the drag from slower, more defensive sectors.

For a swing trader, QQQ's exclusion of financials is a feature, not a bug. It provides a purer play on technological innovation and market leadership, creating amplified moves that are ideal for capturing short-to-medium term price swings.

The S&P 500: The Diversified Market Barometer

SPY is built for a totally different job. By including companies from all 11 GICS sectors, it offers a much more balanced and diversified look at the U.S. economy. Its market-cap weighting means the biggest companies still have the most pull, but its sheer breadth gives it a stability that QQQ just doesn't have.

This diversification has real, practical implications for traders. During times of economic uncertainty or when investors start rotating out of high-flying growth stocks, SPY tends to hold up better. Its exposure to defensive sectors like healthcare, utilities, and consumer staples can act as a cushion against the kind of sharp sell-offs that often hammer the tech-heavy QQQ.

The structural difference becomes obvious when you put them side-by-side:

- QQQ Composition: A concentrated bet on roughly 100 of the market's most dynamic, non-financial companies.

- SPY Composition: A broad, diversified portfolio of about 500 companies, meant to reflect the entire economic landscape.

So, when it comes to the QQQ vs. SPY debate, you’re not just picking an ETF. You’re choosing your exposure. Do you want to align your trade with the focused, high-beta engine of modern growth (QQQ)? Or are you looking to trade the pulse of the entire U.S. large-cap market (SPY)? The right answer depends entirely on the market environment and the specific opportunity you're trying to nail.

Looking Past the Headline Returns

Judging QQQ and SPY on annual returns alone is a rookie mistake. It’s like picking a car based only on its 0-60 time without checking how it handles a sharp turn in the rain. For a swing trader, the real story is in the volatility, the drawdowns, and how each ETF behaves when the market gets messy. A closer look at the numbers reveals two completely different animals, each with its own rhythm for us to trade.

There’s no denying QQQ often steals the show on raw performance, especially over the last decade. It has consistently outrun SPY, making it a go-to for traders who hunt for momentum and relative strength. To put it in perspective, QQQ delivered a stunning 20.94% annualized return over the past 10 years, while SPY clocked in at 15.88%. A 10,000** investment in QQQ would have grown to over **65,000, dwarfing the $43,000 you’d have from SPY.

But here’s the trade-off. Digging into the long-term data from April 1, 1999, to January 9, 2026, you see the price for that performance. QQQ’s Sharpe ratio is 0.50 with a gut-wrenching max drawdown of -83.0% and a standard deviation of 27.0%. SPY, meanwhile, has a nearly identical Sharpe of 0.51 but a much shallower -55.2% drawdown and lower volatility at 19.3%. You can explore a detailed stock comparison to see more about these ETF behemoths.

The takeaway is crystal clear: QQQ's higher returns are fueled by significantly higher volatility. For a swing trader, this is both an opportunity and a threat. Big swings are what we trade, but they also demand airtight risk management.

How They Handle Different Market Weather

The true test of a trading vehicle isn't how it does when the sun is shining; it's how it performs in a storm. QQQ and SPY behave very differently depending on the market's mood.

- Bull Markets: When the market is in a clear, growth-led uptrend, QQQ is the undisputed king. Its heavy tech concentration acts like a turbocharger. As risk appetite soars, money pours into the Nasdaq-100 leaders, and QQQ often leaves SPY in the dust. This is prime time to be long QQQ.

- Bear Markets: When the tide goes out, QQQ's concentration becomes its Achilles' heel. The same high-beta names that rocketed up are the first to get slammed on the way down. SPY, with its broad mix of defensive sectors like Healthcare and Utilities, provides a much softer landing. Its drawdowns are almost always less severe, making it a safer bet when the market is breaking down.

- Sideways Markets: Choppy, directionless markets are tough for both. However, SPY often presents more discrete opportunities here, as traders can play the rotations between its eleven sectors. QQQ can get stuck in the mud if its handful of mega-cap generals can't find a direction.

For a swing trader, the goal isn't just to pick the "best" ETF. It's about picking the right one for the current market environment. The skill lies in knowing when to press your bets with QQQ and when to play defense with SPY.

Gauging Risk-Adjusted Performance

Smart traders never look at returns in a vacuum. We always ask, "How much risk did I take to get that return?" Metrics like the Sharpe and Sortino ratios give us a clear answer.

The Sharpe Ratio is the classic metric, measuring your return against the total volatility you endured. Interestingly, the long-term Sharpe ratios for QQQ and SPY are often neck-and-neck, both hovering around 0.50. This tells us that even though QQQ posts bigger gains, its wild swings mean that on a risk-adjusted basis, it isn't necessarily a "better" trade than the slow-and-steady SPY.

I find the Sortino Ratio more practical for trading because it only penalizes for downside volatility—the risk we actually care about. It helps answer the question, "Am I being compensated for the painful drops?" While the numbers vary by timeframe, the theme remains the same: QQQ's explosive moves come at the cost of nauseating drawdowns.

If you're going to make QQQ your primary trading vehicle, you have to be ready to manage that downside with disciplined stops and careful position sizing. This kind of data-driven analysis is essential for building a solid swing trading plan for 2026 and beyond.

How Sector Exposure Drives Performance

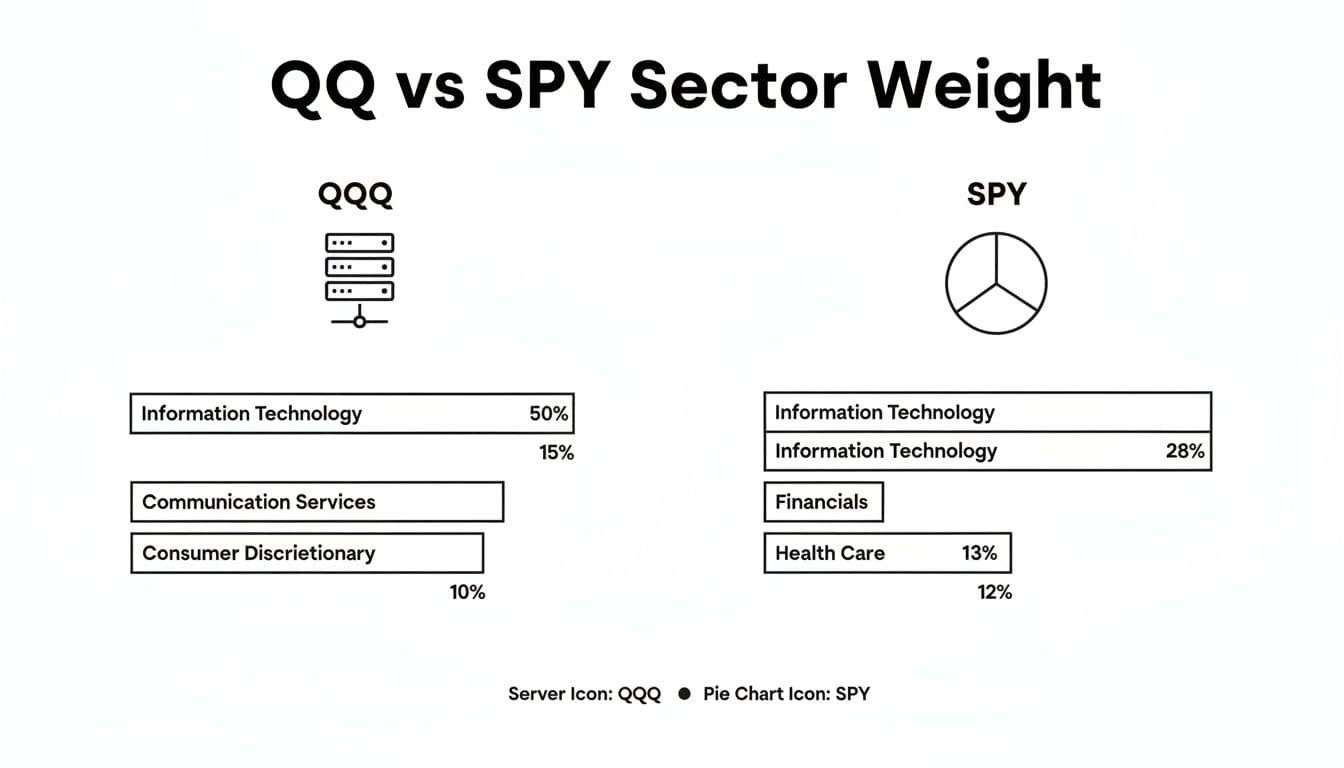

The performance gap between QQQ and SPY isn't random. It’s a direct consequence of their wildly different sector DNA. While SPY gives you a balanced slice of the whole U.S. large-cap pie, QQQ makes a massive, concentrated bet on technology and growth. For a swing trader in 2026, getting this distinction is everything—it tells you which ETF to grab and when.

Think of SPY as the market's pulse. It’s built to mirror the broad economy, with exposure across all eleven GICS sectors. Sure, tech is its biggest piece, but that's balanced out by heavy hitters in Financials, Healthcare, and Consumer Discretionary. This diversification is a built-in buffer, often softening the landing when the market gets spooked and money flees to safer corners.

QQQ, on the other hand, pretty much lights the idea of diversification on fire. It completely boots the Financials sector and goes all-in on innovation. What you're left with is a fund dominated by technology and tech-related sectors, giving it a much higher beta and a far more aggressive personality.

The Concentrated Power of the QQQ Effect

There’s a phenomenon traders call the "QQQ Effect," which is really just a way of describing the massive influence a small group of mega-cap growth stocks has on the fund. This isn't just a slight lean; it’s baked into its structure. QQQ's fate is tied directly to a handful of powerhouse companies, creating an incredible momentum engine when those stocks are in favor.

This concentration is why the QQQ vs. SPY debate matters so much for traders. You can see how institutional money is flowing and which themes are leading the market. It’s pretty wild when you dig in: 82 of QQQ's 100 stocks are also in the S&P 500, and they make up a whopping 40% of SPY's total weight.

But here’s the kicker: giants like Microsoft, Apple, Amazon, and Google account for a staggering 41.34% of QQQ. In SPY, that same group is only 19%. This gap has widened significantly in recent years as their market caps exploded, fueling the massive outperformance we saw after 2019 when the QQQ/SPY ratio rocketed higher. If you want to see this in action, StockCharts has a detailed analysis that quantifies the QQQ effect perfectly.

Bottom line: when you trade QQQ, you’re not just buying the Nasdaq-100. You're making a high-conviction, leveraged-style bet on the market's biggest growth stories.

In QQQ, the top ten holdings often gobble up over 50% of the ETF's entire weight. For SPY, that number is closer to 30%. This concentration is QQQ's greatest weapon in a bull market and its biggest vulnerability when things turn south.

Practical Implications for Swing Trading

So what does an active trader do with all this? It boils down to matching your vehicle to the market's mood. My entire open swing trading approach is built on sniffing out where the big money is going, and sector analysis is my go-to tool.

Here’s a simple framework for 2026:

- Assess Sector Leadership: Is tech outperforming everything else? When the Technology Select Sector SPDR Fund (XLK) is showing clear relative strength against SPY, that's a bright green light for QQQ's aggressive setup.

- Monitor Defensive Rotations: On the flip side, are "boring" defensive sectors like Utilities (XLU) or Consumer Staples (XLP) catching a bid? That's a classic "risk-off" signal, and it's a time when SPY's diversified structure is likely to hold up much better than QQQ's high-beta build.

- Watch the Mega-Caps: Keep the charts of QQQ's top five holdings on your screen. Since they have so much sway, their collective trend is often a leading indicator for QQQ itself. If the generals are leading the charge, the army will follow.

By reading the sector flows, you elevate your decision from a simple QQQ vs. SPY coin flip to a tactical choice. You’re picking the ETF whose very DNA is designed to capitalize on the market's current path, giving your trades a powerful structural tailwind.

Actionable Swing Trading Strategies

Theory is one thing, but making money as a swing trader boils down to having practical, repeatable strategies. For an active trader in 2026, deciding between QQQ and SPY isn’t just an academic exercise—it’s about picking the right tool for a specific job in the market. Each ETF really calls for its own unique approach to entries, risk management, and the overall philosophy behind the trade.

The real key is to stop thinking of them as competitors and start seeing them as specialized tools in your kit. Your first job is always to read the market environment. Only then can you select the tool designed to work best in those specific conditions. This is what separates data-driven trading from just guessing.

Riding the Momentum Wave with QQQ

When it's time to be aggressive and trade momentum, QQQ is your go-to. Its higher volatility and deep concentration in tech make it the perfect vehicle for capturing those explosive moves when the market is clearly in a "risk-on" mood.

Here are a few specific scenarios where trading QQQ makes sense:

- Relative Strength Breakouts: Watch the QQQ/SPY ratio. When it's trending up, it’s a clear signal that big money is pouring into growth stocks. A swing trader can use this as confirmation, looking for QQQ to break out of a consolidation pattern on heavy volume.

- Thematic Leadership Plays: If a hot tech narrative like AI or semiconductors is grabbing all the headlines, QQQ is the simplest way to trade that broad momentum. Instead of trying to pick the one winning stock, you can ride the entire theme's tailwind.

- Post-Correction Rebounds: After a market-wide pullback, QQQ almost always rebounds faster and harder than SPY. Its high-beta nature means it snaps back with more force, offering a fantastic reward-to-risk trade for traders who can nail the timing.

Just remember, because of its volatility, your risk management with QQQ has to be on point. The wider price swings often mean you'll need to use a slightly larger stop-loss percentage while maybe trimming your position size to keep your dollar risk consistent.

A core benefit of a structured swing trading routine is identifying these "risk-on" periods with objective data. When market breadth is strong and growth sectors are leading, QQQ becomes the logical choice for deploying capital, allowing you to align your trades with institutional momentum.

Navigating the Market with SPY

Think of SPY as the versatile workhorse of your trading toolkit. Its lower volatility and incredibly diversified holdings make it a much better choice for trading broad market sentiment, playing defensive rotations, or even hedging other growth-oriented positions in your book.

Here are some actionable strategies for SPY:

- Trading Broad Market Sentiment: When you have major economic data releases or a Fed announcement on the calendar, SPY gives you the purest way to trade the market's reaction. It reflects the overall consensus without the noise from a single, dominant sector like you get with QQQ.

- Playing Sector Rotations: During times of uncertainty, you'll often see money move out of aggressive growth stocks and into defensive sectors like Utilities (XLU) or Healthcare (XLV). SPY holds up much better during these periods. A weakening QQQ/SPY ratio can be your cue to favor short-term trades in SPY.

- Hedging a Growth-Heavy Portfolio: Let's say your portfolio is loaded with high-beta tech stocks. Taking a short position in SPY can be a very effective hedge when the market starts to look weak, helping to smooth out your portfolio's equity curve.

This chart really drives home the stark difference in sector concentration that leads to these distinct trading behaviors.

You can see right away how heavily QQQ is weighted toward technology, whereas SPY gives you a much more balanced distribution that mirrors the entire economy.

A Repeatable Workflow for 2026

To make an objective call in the QQQ vs. SPY debate, you need a simple, repeatable process. This kind of workflow gets emotion out of the way and forces you to focus on what the market is actually telling you.

- Assess Market Breadth: First, check the market's internal health. Are more stocks advancing than declining? Is the Advance-Decline Line moving in the same direction as the index? Strong breadth is your green light for getting aggressive.

- Analyze Sector and Capital Flows: Next, follow the money. Is the Technology sector showing powerful relative strength, or are funds rotating into defensive areas? This tells you if the market is in a "risk-on" or "risk-off" posture.

- Select Your Vehicle: With that data in hand, the choice becomes pretty clear. If breadth is strong and tech is leading the charge, QQQ is the right tool. If breadth is weak and defensive sectors are catching a bid, SPY is the more stable and predictable instrument for the job.

This structured process is the heart of a modern swing trading plan. It turns a complex decision into a simple, data-driven choice.

Common Questions on Trading QQQ vs. SPY

When you're trying to decide between QQQ and SPY, a few practical questions always seem to pop up. Let's tackle the most common ones with direct, actionable answers to help you trade smarter in 2026.

Which ETF Is Better for a Beginner Swing Trader, QQQ or SPY?

If you're just getting your feet wet in swing trading, SPY is almost always the better place to start. Its broad diversification across all major U.S. sectors means its price action is a solid reflection of the overall market. This typically translates to lower volatility compared to QQQ.

That smoother ride can be a lot more forgiving while you're still mastering risk management and getting a feel for an open swing trading approach. QQQ, with its heavy lean into tech, is a higher-beta beast with bigger, faster price swings. While that can amplify profits, it also brings a level of risk that's tough for a rookie to handle. Think of it this way: use SPY to master reading market trends before you step up to more volatile instruments.

Can I Use Both QQQ and SPY In My Swing Trading Portfolio?

Absolutely. In fact, using both is a pretty sharp way to gauge what the market is really thinking. Many experienced traders keep a close eye on the QQQ/SPY ratio as a real-time indicator of risk appetite.

- When the ratio is rising, it means tech (QQQ) is leading the broader market (SPY). This signals a "risk-on" mood, which is often a green light for more aggressive swing trades.

- When the ratio is falling, it suggests a defensive shift is underway. In that environment, you might want to ease off your QQQ exposure or stick with SPY for more stable setups.

Holding positions in both can also work as a kind of internal hedge, balancing the aggressive growth of tech against the stability of the entire market.

How Do Options Liquidity and Spreads Compare?

Both QQQ and SPY have fantastic options liquidity, which is a huge plus for any swing trader using derivatives. But if we're splitting hairs, SPY generally has the edge. As the oldest and biggest ETF on the block, the SPY options market has unmatched volume, which means the bid-ask spreads are typically razor-thin—often just $0.01 wide.

This makes getting in and out of your trades cheaper and cleaner. QQQ's options are also incredibly liquid with tight spreads, but SPY is truly the gold standard. For traders who define their risk with options, either one is a great choice, but SPY’s slight edge in liquidity can really matter, especially on larger orders.

The key takeaway is that while both are liquid, SPY’s options market is the most efficient on the planet. This can translate to less slippage and better fills, which adds up over many trades.

What Timeframe Works Best for Swing Trading These ETFs?

The right timeframe really hinges on your specific strategy, but both ETFs are perfect for classic swing trading durations, which usually means holding a position for a few days to a few weeks to catch a single price move.

Because it moves faster, QQQ often serves up clear setups on 1-hour and 4-hour charts. This allows traders to jump on those strong, multi-day momentum bursts. SPY, being a bit calmer, tends to show cleaner, more defined trends on the daily chart, making it ideal for capturing those broader market shifts that play out over one to three weeks.

Ready to stop guessing and start making data-driven trading decisions? OpenSwingTrading provides the objective market context you need to identify high-probability setups in just minutes a day. Assess market health, follow institutional capital flows, and find the strongest stocks poised for breakouts. Start your free 7-day trial today!