Why your episodic pivot entries fail after earnings gaps

A practical troubleshooter for why episodic pivot entries break after earnings gaps—identify failure symptoms, isolate root causes, run a fast diagnosis flow, and rebuild levels/entry logic with risk sizing and prevention protocols.

Why your episodic pivot entries fail after earnings gaps

A practical troubleshooter for why episodic pivot entries break after earnings gaps—identify failure symptoms, isolate root causes, run a fast diagnosis flow, and rebuild levels/entry logic with risk sizing and prevention protocols.

Your pivot looked perfect yesterday, then earnings hits and the open is a cliff—suddenly every “clean” retest turns into a stop-out or a chase. If you keep trading the same playbook through gaps, you’re often trading a different market than the one your levels were built for.

This troubleshooter helps you pinpoint what changed overnight, match the gap type to the common failure mode, and run a quick diagnosis before you place a trade. You’ll rebuild post-gap levels, tighten entry rules, repair sizing, and put a pre-earnings process in place so pivots work when they’re supposed to—and you stand aside when they won’t.

Failure symptoms map

Earnings gaps don’t just move price. They rewrite the auction that made your pivot “obvious” yesterday. If you keep trading the old map, you’ll keep getting the same blunt feedback: fast losses, bad fills, and dead follow-through.

Typical entry outcomes

These show up when you trade a pre-gap pivot like nothing changed. You see the same “clean setup,” then execution and response fall apart.

- Instant stop-outs on first push

- Late fills after the move

- Huge slippage through your stop

- No follow-through after entry

- Repeated fakeouts around the level

That cluster usually means the level lost authority and liquidity got thin.

Gap types that hurt

Some gaps don’t just jump price. They shift who’s in control, and your pivot becomes the wrong reference. A gap-and-go can turn your “breakout pivot” into a chase entry. A gap fade can turn your “support pivot” into a liquidity trap. A gap fill often creates two-sided trade, where pivots get chewed up. A gap above resistance can invalidate the old ceiling, then retest it with violent spreads. A gap into supply or demand can trigger immediate absorption, then whip back through your trigger. The common thread is regime change, not bad timing.

What changed overnight

You need a fast diff between the pre-earnings market and the post-gap market.

- Mark the prior range and midpoint, then note if it’s fully jumped.

- Compare volume profile shape, looking for a new HVN or air pocket.

- Check ATR expansion, then resize stops or disqualify the setup.

- Redraw key levels from the gap day open, not yesterday’s close.

- Read the news angle, then label “re-rate” versus “knee-jerk.”

If three items changed, you’re trading a new instrument with the old rules.

When pivots still work

Episodic pivots can survive when the gap doesn’t break structure. You’re looking for a small gap, quick balance, and spreads that stop acting haunted. The best cases show clean acceptance above or below the level, with prints that hold instead of instantly retracing. Think “gap, pause, build,” not “gap, rip, vanish.” Your edge comes back when the market starts respecting references again.

Root causes checklist

You’re not missing “better pivots.” You’re trading yesterday’s map after a company reset the terrain overnight.

Use this checklist to identify what actually broke: regime, volatility, microstructure, levels, flows, or timing.

Regime shift

Earnings doesn’t just move price. It reprices the whole distribution, like the stock just got a new fair-value range.

Your prior swing pivots were built inside the old value area. After a gap, they can become irrelevant reference points, even if price revisits them.

Treat it like a new auction. Old pivots are trivia until the market shows acceptance around them.

Volatility expansion

After earnings, your entry fails because your “normal” noise filter is too small. You need proof that the tape’s breathing changed.

- ATR jumps 30–100%+ overnight

- Candles widen and overlap less

- Opening range doubles in size

- Implied volatility stays elevated

- Wicks grow near levels

Size and timing must adapt first. Your setup comes second.

Liquidity and spreads

Your pivot can be right and still lose money. Microstructure decides whether you can enter and exit without donating edge.

- Check spread at your entry time, not mid-day.

- Check depth and top-of-book churn at your price.

- Check volume-at-price near the gap edge and pivot.

- Check halt risk and opening auction irregular prints.

- Check your slippage history on similar earnings days.

If fills get worse, your expectancy collapses silently.

Level invalidation

A gap that clears a pivot by a mile turns that pivot into mid-range noise. Price can tag it and keep going, because the market already voted.

Support and resistance only “flip” after acceptance, like multiple closes and good volume holding the new side. A single touch is just a drive-by.

Wait for the level to earn relevance again. Otherwise you’re trading a line, not a market.

Order-flow distortion

Post-earnings tape is crowded with non-setup flows. Those flows can overwhelm your clean pivot logic for days.

- Funds rebalance and index flows hit

- Hedges unwind into open interest walls

- Analyst notes trigger delayed demand

- Buybacks pause in blackout windows

- Shorts cover into thin offers

Identify the dominant flow first. Your pivot is just where it expresses.

Timing mismatch

Episodic entries assume price responds to technical memory. Right after earnings, catalysts dominate and memory is weak.

You do better waiting for balance, then trading the break with confirmation. A “perfect” pivot touch during chaos is usually a trap.

Let the market finish repricing. Then trade what remains.

Fast diagnosis flow

You need a fast call on gap day: trade your pivot rules, adapt them, or do nothing. Use this flow before the open, then again in the first 15 minutes.

- Classify the gap: <2% normal, 2–6% tradable, >6% regime change.

- Check context: earnings, guidance, or sector news driving the move.

- Map location: above resistance, into resistance, or below support.

- Read the open: holds gap, fades gap, or whipsaws both sides.

- Choose action: trade pivots, widen filters, or stand down.

Your edge isn’t predicting the gap; it’s refusing the wrong playbook.

Rebuild your levels

Earnings gaps rewrite the auction. Your pre-earnings pivots are history, not structure.

Rebuild around what actually trades post-gap: VWAP, the opening range, gap midpoint, and value edges. If you anchor there, your “episode” has a real map again.

Post-gap anchors

Start with the gap as the new reference frame. Then layer intraday levels the market keeps touching.

- Mark the gap range: prior close to today’s open.

- Mark the gap midpoint: 50% of the gap.

- Mark premarket high and low.

- Mark the opening range high and low.

- Mark VWAP and first pullback to it.

Then watch where volume accepts and stops defending. That’s your real pivot.

Acceptance vs rejection

Levels work when price accepts them, not when you want them to. You’re reading behavior, not drawing lines.

Acceptance looks like: time spent above a level, higher lows into it, and volume holding after the touch. Rejection looks like: fast snaps away, long wicks, and failed retests that flip support to resistance. Trade the retest only after the tape picks a side.

Event-day structure

Give the day a label early. Your pivot reliability changes with the day type.

- Trend day: pivots break once, then retest cleanly.

- Balanced day: pivots chop; fade extremes, not middles.

- Failed breakout: pivots trap; trade back through the failure.

- Gap fill: pivots matter near the fill path and midpoint.

- Range expansion: pivots reset; use OR and VWAP first.

Pick the label, then pick the playbook. Otherwise you’re forcing mean reversion into momentum.

Multi-timeframe sanity

Execute on 1–5m, but decide on 30–60m. The gap often creates a new higher-timeframe range in one candle.

If your 5m “pivot” sits inside a 60m imbalance, it’s a speed bump, not a wall. Wait for the higher-timeframe level to accept or reject first, then use micro levels for entries and risk. That’s the line between precision and noise.

Fix entry logic

Earnings gaps break your usual pivot logic because price discovery resets. A level that “should hold” becomes a magnet, then a trap. Swap prediction entries for confirmation setups that force the market to prove direction first.

Retest entry rules

You need rules that assume the first move is noisy. You also need a clean place to be wrong, fast.

- Wait for a break and close beyond the pivot.

- Let price pull back to the broken level.

- Require a hold: rejection wicks or a tight base.

- Trigger on continuation through the pullback high or low.

- Invalidate beyond the retest low or high.

Your edge comes from acceptance, not the first spike.

ORB variation

Gaps often form direction during the opening window. Pick an ORB style that matches volatility and liquidity.

- Trade 5-min break when trend is clean.

- Trade 15-min break when open is chaotic.

- Buy first pullback after break for better R.

- Fade failed ORB when it snaps back.

- Add VWAP filter when chop dominates.

If the open feels random, upgrade the filter, not your conviction.

VWAP filters

VWAP tells you if the gap move is being accepted or sold into. Use slope and distance, not a single touch.

A steep VWAP slope supports continuation. Flat VWAP warns of rotation. Avoid entries stretched far from VWAP, even if the level “looks perfect.” For longs, require reclaim and hold above VWAP. For shorts, require loss and hold below VWAP.

Distance from VWAP is your hidden risk multiplier.

No-trade triggers

Sometimes the best entry logic is standing down. Gaps can turn your setup into a liquidity tax.

- Spreads stay wide past the open.

- Halts interrupt price discovery.

- Whipsaw chops around VWAP.

- News drip changes the story.

- ATR is extreme versus normal.

When conditions block confirmation, you’re not missing trades. You’re skipping landmines.

Risk sizing repairs

Post-earnings gaps change the game because volatility is discontinuous. Your old pivot math assumes smooth order flow, and earnings never delivers that.

Stop placement

Pivot-adjacent stops fail because the gap creates new reference points, and everyone sees the same pivot. You get tagged on the first sweep, then price does the “real move” without you.

Anchor stops to post-gap structure instead:

- Beyond opening range low/high

- Beyond the first retest low/high

- Beyond the gap midpoint

- Outside a VWAP band, not on VWAP

Your stop should sit where the post-earnings thesis is invalid, not where it’s merely uncomfortable.

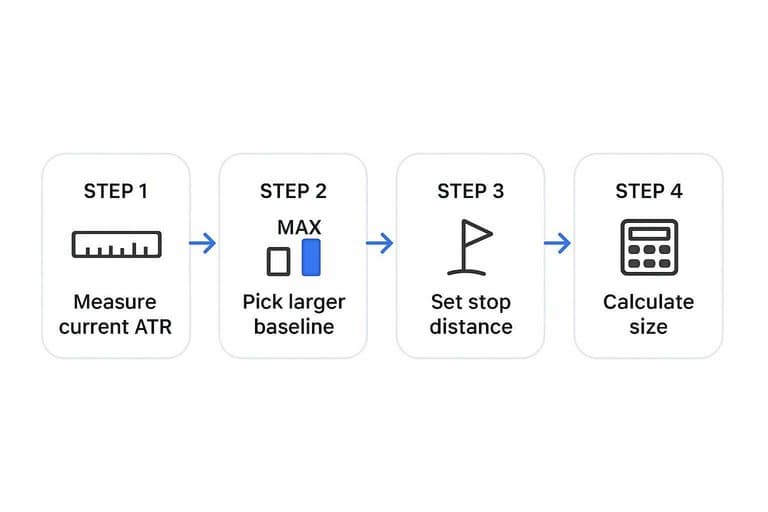

Size from ATR

Use today’s volatility, not last week’s, to set size and survive the whipsaw.

- Measure current ATR and opening range size.

- Pick the larger one as your volatility baseline.

- Set stop distance from structure plus baseline fraction.

- Calculate size: risk dollars ÷ stop distance.

- Cap leverage and add a slippage haircut.

If the stop has to be wide, size gets small. That’s the whole point.

Target logic

Post-earnings, targets need to match the day’s engine, not your hope. Use levels that other participants actually trade.

- Gap fill level

- Prior close

- Opening range measured move

- Daily ATR bands

- Value edge from volume profile

If your target needs a trending day, don’t force it on a chop day.

Slippage buffer

Your max loss rule breaks when fills slip, spreads widen, and stops trigger in fast air pockets. Add a buffer for spread and volatility, or your “$200 risk” becomes $350 on the statement.

Use limit or stop-limit orders when liquidity is thin and the tape is jumpy. Avoid market orders in the first minutes after the open.

If you can’t control entry quality, you can’t control risk. Period.

For deeper market-structure context on why execution quality degrades in fast markets, see the SEC’s staff report on algorithmic trading.

Troubleshooting table

Use this to match what you see after an earnings gap to what actually broke, then run one quick check before changing rules.

| Symptom | Likely cause | Diagnostic check | Fix |

|---|---|---|---|

| Stops hit instantly | You ignore gap risk | Entry inside gap size | Skip earnings window |

| Fill is unrealistic | You assume mid fills | Compare to NBBO | Use limit logic |

| Win rate collapses | Regime changed post-earnings | Volatility percentile jump | Filter by IV rank |

| Pivots misfire | Level invalidated by gap | Prior close breached | Redraw from open |

| Slippage spikes | Liquidity vanished at open | Spread > normal | Delay first minutes |

If the check passes, don’t tweak entries; fix the constraint you violated.

Pre-earnings prevention

You don’t have an “episodic pivot” problem. You have an earnings-gap process problem.

Build a protocol that treats earnings like a different instrument. Then your pivots stop getting blindsided by overnight repricing.

Earnings calendar protocol

Earnings gaps are scheduled volatility, not surprise risk. Your system needs a default behavior when earnings are near.

- Check earnings dates at the open and before every new position.

- Cut size as earnings approach, based on your plan.

- Don’t hold through earnings unless it’s explicitly allowed.

- Define which pivot setups are allowed pre-earnings.

- Set max slippage and halt rules for gap opens.

If you can’t say what happens on earnings week, earnings week runs your account.

Backtest by regime

Earnings gaps change the whole distribution of outcomes. One backtest bucket hides that.

Split results by gap size, ATR expansion, and day type, like trend day or mean-revert chop. Only trade pivot variants that show edge inside each regime.

Your “best setup” might be dead on 2x ATR days. Treat it that way.

Checklist before entry

You need a gate that stops you from forcing a normal play onto a weird day. A checklist does that fast.

- Identify gap context versus prior range.

- Confirm acceptance level on higher timeframe.

- Check VWAP position and slope.

- Define OR state: balance or breakout.

- Verify spread and liquidity quality.

- Confirm relative volume versus average.

- Classify day type from early structure.

- Mark stop location beyond structure.

- Validate risk-reward after slippage.

- Scan news: earnings, guidance, halts.

If you can’t clear the checklist in 30 seconds, you’re trading hope.

Post-trade review loop

Earnings-gap damage repeats because you don’t label it precisely. “Bad trade” is not a category.

Log screenshots, entry/exit metrics, slippage, and halt behavior. Tag each trade by gap type and setup variant, then tighten rules until the same failure can’t happen twice.

When the log says “gap-and-go + wide spread = no,” your future self stops bleeding.

Turn post-earnings chaos into a repeatable decision

- Classify the gap and outcome: Identify the gap type (trend, reversal, exhaustion, no-man’s-land) and your symptom (instant stop, no fill, chop, runaway).

- Run the root-cause checklist: Confirm regime shift, volatility expansion, liquidity/spread changes, level invalidation, order-flow distortion, and timing mismatch.

- Rebuild levels from post-gap anchors: Use event-day structure and acceptance/rejection to redraw levels across multiple timeframes.

- Update entry + risk in tandem: Add retest/ORB/VWAP filters, define no-trade triggers, then size from ATR with slippage buffers and realistic stops/targets.

- Prevent the next one: Follow an earnings calendar protocol, backtest by regime, and log post-trade notes so your rules evolve with the market—not your emotions.

Frequently Asked Questions

Does the episodic pivot strategy still work in 2026 with post-earnings volatility and faster algos?

Yes—most traders just need to treat earnings gaps as a different regime and require confirmation (VWAP/ORB/retests) instead of assuming old pivots will hold. The edge usually comes back when you trade fewer, higher-quality pivots and size to the new ATR.

Can I use episodic pivot entries on earnings day, or should I wait for the next session?

Most traders get cleaner signals by waiting for the first 30–60 minutes to set ORH/ORL and VWAP before taking an episodic pivot entry. If spreads are wide or the first hour range is extreme, the next session often provides better retests and tighter execution.

How do I know if an earnings gap has invalidated my episodic pivot level?

Assume invalidation when price opens beyond the level by more than ~0.5–1.0× ATR(14) or never trades back to it with meaningful volume. A quick check is whether VWAP and the opening range form new “accepted” references that price respects instead of the old pivot.

What are realistic win rates and R-multiples for episodic pivot trades after earnings gaps?

On gap-driven setups, many traders target ~1.5R to 3R because stops are wider and follow-through can be strong, but the win rate is often lower than normal pivot days. Track expectancy (win% × avg win − loss% × avg loss) over at least 30–50 trades to judge if your post-gap rules are working.

What’s the best alternative to episodic pivot if I don’t want to trade earnings gaps?

Stand down on the gap day and switch to next-day continuation/reversion using VWAP, prior day high/low, and the gap midpoint as the primary references. Another common alternative is options (defined-risk debit spreads) to cap risk when volatility and wicks are unpredictable.

Find Cleaner Episodic Pivots

Earnings gaps can scramble levels and relative strength, so episodic pivot entries fail even when your checklist and diagnosis flow are solid.

Open Swing Trading helps you rebuild context fast with daily RS rankings, breadth, and sector/theme rotation so you focus on the most actionable leaders—get 7-day free access.